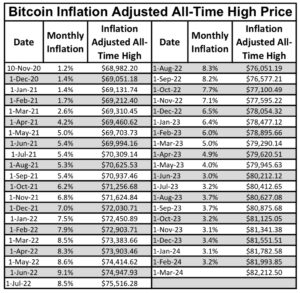

As of March 1, 2024 the inflation adjusted all-time high (IAATH) for bitcoin was roughly 82,212.50 (compared to an unadjusted all-time high of ~72,700). This figure is a fairer assessment of how bitcoin is gaining value compared to the US dollar. Part of the case for Bitcoin’s value is centered around inflation so using the IAATH number is a more apt and honest comparison. This is particularly true given the inflation that has plagued the United States since the previous all-time high in November 2020.

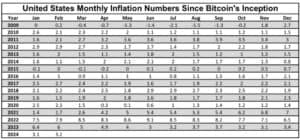

A quick glance at the chart below and it is easy to see that the highest months of inflation have almost exclusively occurred since the November 10, 2020 all-time high, including a 28 month stretch that had inflation of higher than 4 percent. Stated differently the US inflation rate was at least twice as much as the Feds’ target inflation rate of two percent and in some months it was in excess of four times the Fed’s target rate.

Had the Fed been able to achieve its 2 percent inflation goal since the November 10, 2020 ATH the IAATH would have been 73,856.57 as of March 2024. That number is materially different,8,355.93 (or 11,605,458 satoshis for the 1 bitcoin = 1 bitcoin crowd), from the IAATH of $82,212.50. That is why the IAATH for the bitcoin price is more pertinent this cycle compared to previous cycles where the Fed was within the range of its 2 percent inflation target.

There has been a lot of literature lately regarding how quickly the bitcoin price has doubled when a previous ATH has been reached. It will be interesting to see if those numbers are more correlated to the unadjusted ATH or when bitcoin reaches a new Inflation Adjusted All-Time High. The pertinent question becomes when will the surging bitcoin price chase down and achieve a new inflation adjusted all-time high? I don’t like to pontificate on price as it is a cheap way to earn clicks but I doubt I get to harp on this issue for much longer. Until then I’ll nominate myself as the leader of Team IAATH!