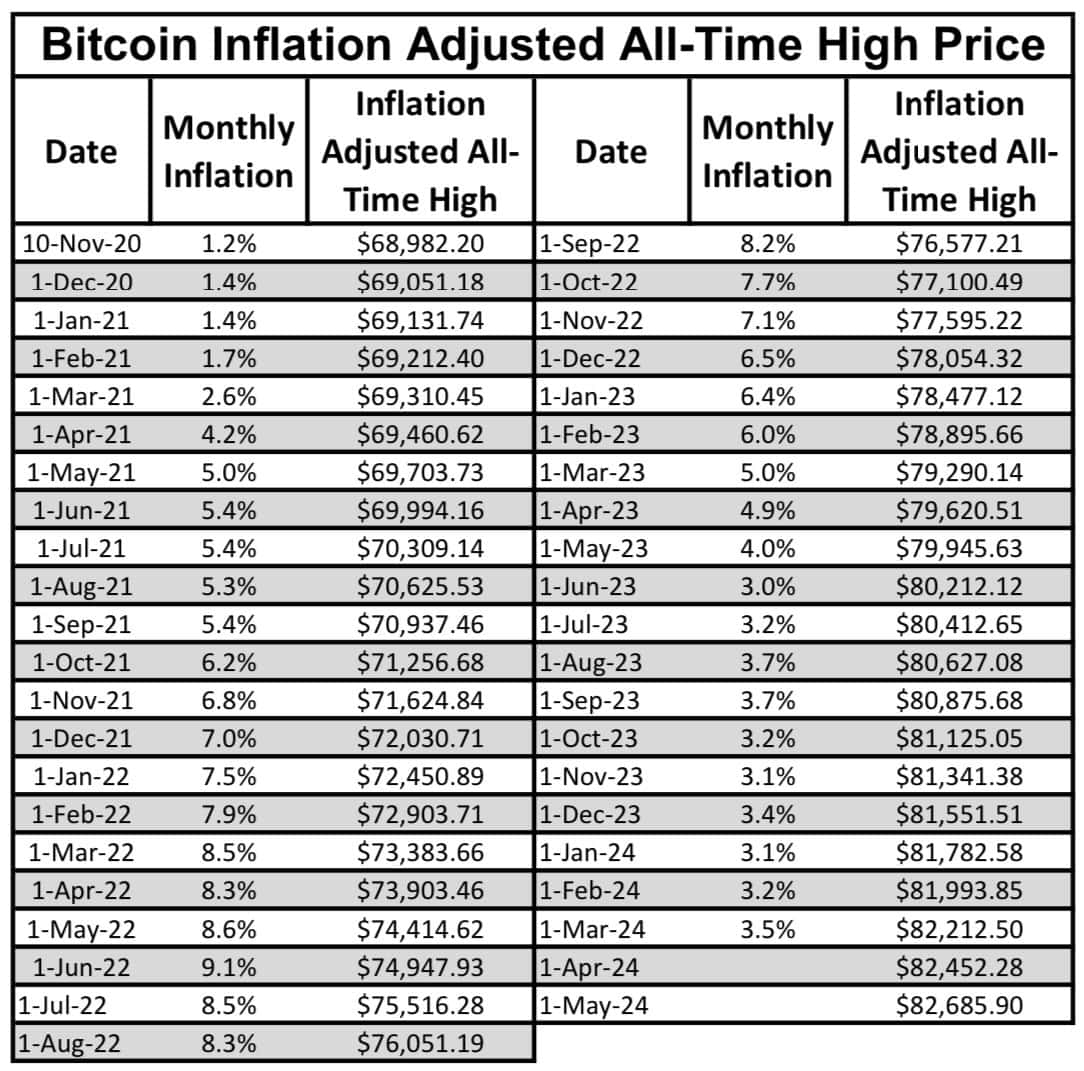

As of May 1, 2024 the inflation adjusted all-time high (IAATH) for bitcoin was roughly 82,685.90 (compared to an unadjusted all-time high of73,738.00). The IAATH figure is a fairer assessment of how bitcoin is gaining value compared to the US dollar. Part of the case for Bitcoin’s value is centered around inflation so using the IAATH number is a more apt and honest comparison. This is particularly true given the inflation that has plagued the United States since the previous all-time high of $68,982.20 in November 2020. Stunningly, since November 2020 the United States has averaged 5.2 percent inflation according to the government’s CPI inflation number which may be significantly understating the true impact inflation has had on the country’s economy.

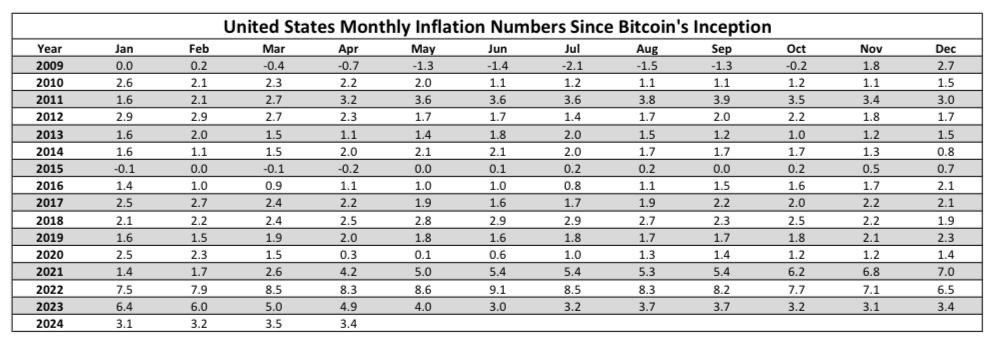

A quick glance at the chart below and it is easy to see that the highest months of inflation have almost exclusively occurred since the November 10, 2020 all-time high, including a 28 month stretch that had inflation of higher than 4 percent. Stated differently the US inflation rate was at least twice as much as the Feds’ target inflation rate of two percent and, in some months, it was in excess of four times the Fed’s target rate.

Had the Fed been able to achieve its 2 percent inflation goal since the November 10, 2020 ATH the IAATH would have been 74,102.96 as of April 2024. That number is materially different,8,582.94 (or 12,054,691 satoshis for the 1 satoshi = 1 satoshi crowd), from the IAATH of 82,685.90. Similarly, the unadjusted ATH of73,738.00 is materially different, 8,714.28 (or 12,239,157 satoshis) from the IAATH.

In previous cycles the IAATH and the ATH were closer for two reasons. First, the ATH was a lower number which meant that any inflationary number had a smaller impact. Basic arithmetic demonstrates that a percentage will have a larger impact on higher numbers. Therefore, it is certain that as bitcoin’s ATH number grows, the impact inflation has on the ATH will be larger. For example, two percent of20,000 is 400 while two percent of70,000 is 1,400. As the ATH number continues to rise, the IAATH will become the relevant number when comparing bitcoin’s price to previous cycles.

Second, the inflation the United States has experienced is much larger compared to previous cycles. Since the previous cycles ATH of68,982.20, which is still the pertinent number for the IAATT, the United States has averaged 5.2 percent inflation according to the government’s CPI inflation number. The previous cycles ATH was reach on December 16, 2017 when the price of bitcoin reached 19,188.00. The price of bitcoin did not exceed that unadjusted all-time high until almost three years later when it reach the price of19,246.00 on December 14, 2020. During that three year span, including the bookend months of December 2017 and December 2020, the government’s average CPI inflation number was 1.8 percent. Factoring in the inflation that occurred between December 2017 and December 2020 the IAATH was 20,307.41 a difference of1,119.41. Poetically the price of bitcoin surpassed that IAATH on December 16, 2020, a mere two days after passing the unadjusted ATH, exactly three years after the previous ATH.

Hopefully, the United States and the world are able to curtail the inflation that continues to tax (or rob if you prefer that verbiage) the poorest individuals in our society. However, bitcoin’s ATH number will continue to grow making any inflationary impact more substantial. Therefore, moving forward it is critical and logical the bitcoin community analyze the IAATH as opposed to the ATH.

When bitcoin reached its new unadjusted ATH in early March there was a lot of discussion regarding how quickly the bitcoin price had doubled when the price of bitcoin achieved a previous ATH. However, that doubling scenario does not appear to be developing with this bull market. On March 8, 2024 the price of bitcoin crossed the 70,000 threshold for the first time and achieved an unadjusted ATH. However, unlike previous cycles, the price of bitcoin stagnated before precipitously falling to roughly57,000.00 before rebounding. This type of drawdown has been seen throughout all of bitcoin’s bull runs and is not alarming. Unsurprisingly, as has been seen in previous cycles the price has rebounded again and recently began to threaten the unadjusted ATH. Obviously, there is a bit of hindsight already baked into the cake, but I predict this doubling pattern to more closely be tied to the IAATH as opposed to the ATH moving forward particularly if the world continues to be plagued by crippling inflation.