This is one article in a collection of 52 articles published on the basics of Bitcoin. If you are unfamiliar with bitcoin, some of the early articles in the series will be beneficial for this portion of the series discussing bitcoin treasury companies. Please contact us, if you have any questions or comments.

After a 20 month hiatus from writing one pagers about the basics of bitcoin, I thought it would be appropriate to bring back the series to discuss the hottest topic in the area – bitcoin treasury companies. Recently, some companies have started to mimic the bitcoin treasury playbook pioneered by Michael Saylor at Strategy (formerly known as Microstrategy).

Saylor’s playbook has been an epic success to date leading to Strategy holding 582,000 bitcoin which was acquired for 41 billion dollars at an average price of 70,000 dollars per bitcoin. As of June 9, 2025 the value of Strategy’s bitcoin holdings is 62.7 billion dollars. Strategy’s bitcoin position has appreciated $22 billion and Saylor shows no sign of slowing down. Given the success, it is no surprise other players are jumping in to piggyback on the playbook.

Before diving into some of the intricacies for the strategy of putting bitcoin on a company’s balance sheet it is important to start with some of the principles that are the foundation for the strategy. At the most basic level a company implementing this strategy is borrowing money denominated in fiat and purchasing bitcoin.

To understand why this has been such a successful strategy to date consider these two facts. First, one can say with almost 100 percent confidence that the value of a dollar today will be less in one year than that dollar is worth today due to the Federal Reserves stated two percent annual inflation goal. One thing the government has been able to reliably achieve is meeting its two percent inflation years and in the years the government really wants to disadvantage its poorest citizens it has sometimes managed to double, triple, or even quadruple its target inflation goal.

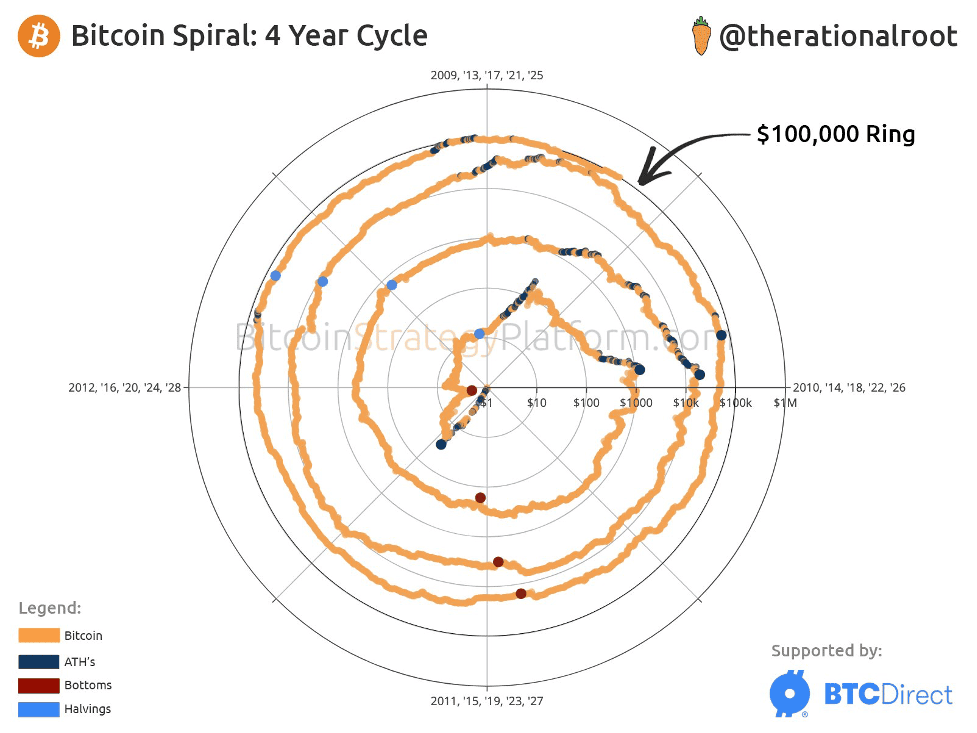

To the contrary, Bitcoin has a 16 year established history of appreciating in value at a staggering rate. One interesting way people view Bitcoin’s halving cycle is in terms of a clock. A halving occurs approximately every 4 years ((210,000 blocks 10 minutes)/(365.25 days 24 hours * 60 minutes) = 3.99 years). Every 52,500 blocks would represent approximately one year of the four-year halving cycle. The next halving will occur in 2028. Viewing the halving cycles as a clock provides myriad interesting insights as the chart below illustrates.

Arguably the most interesting and poignant insight the chart provides is the line representing the bitcoin price never intersects anywhere in the chart. In other words, the price of bitcoin has never been less at that specific point in the halving cycle compared to the previous halving cycle. The spiral has only grown outward. To the contrary, the dollar has fallen in value year after year during the same time frame. Saylor’s insight at its most basic level is borrowing in fiat and acquiring bitcoin to hold long term if not forever. Remember there will only ever be 21 million bitcoin.

While some of the details regarding how companies deploying a bitcoin strategy are utilizing the capital markets to gain access to the capital necessary to acquire the bitcoin is complicated, the underlying premise of the bitcoin treasury strategy is not complicated. Borrow in fiat, a currency that is intentionally being debased by governments, and acquire bitcoin, an asset that is going up forever Laura.