The following is an updated article explaining the basics of Bitcoin. This article was originally published on November 9, 2022 (and in the Benefitslink Retirement Plans Newsletter on November 10, 2022) when the price of bitcoin was $16,000 but was updated to discuss the changes that have occurred within the Bitcoin ecosystem since that date. Much of the content is identical to our original article because the fundamental principles that support Bitcoin have not changed.

Within the last couple of years some employers have offered their workforce the opportunity to make defined contribution investments in various cryptocurrencies. Fidelity, the largest retirement plan provider in the United States, announced it would begin to allow its account holders to invest up to 20 percent of their 401(k) accounts in bitcoin. After Fidelity’s announcement the Department of Labor released Compliance Assistance Release No. 2022-01 which addressed 401(k) investments in cryptocurrencies. Among other items the publication cautioned plan fiduciaries to “exercise extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu for plan participants.” There are several items that are problematic about the DOL guidance that are discussed in concise detail in a letter signed by a host of groups including the American Bankers Association, The ERISA Industry Committee, and the United States Chamber of Commerce. We strongly agree with all of these matters discussed in the letter. However, our biggest concern with the continued guidance issued is that all of the cryptocurrencies are lumped together.

There is still a great misunderstanding by many in the government as well as many fiduciaries and money managers as to what makes Bitcoin unique and stand-alone compared to all other cryptocurrencies, although the spot Bitcoin ETF approval followed by the latest uptick in bitcoin’s price may be signaling more and more understand the difference. As a result, Bitcoin needs to be discussed separately and apart from all other cryptocurrencies as Bitcoin is truly a one of one. The remainder of this paper discusses the history of digital cash and Bitcoin, the rules of Bitcoin and Bitcoin mining which are important to understanding why Bitcoin is distinctly different, and finally, we discuss some of the key differences of Bitcoin compared to all other cryptocurrencies.

Throughout the paper we tried to balance the necessary information that fiduciaries should be aware of when considering Bitcoin as an investment option with not getting bogged down in some of the mind-bending computer science and mathematics that allow the Bitcoin protocol to function. However, readers may need to reread some of the concepts introduced. Where appropriate, there are links that we believed readers would find beneficial to grasp the subject matter. In light of the DOL standard of “extreme care” when examining cryptocurrencies, it was better to error on the side of too much detail as a fiduciary can never be too informed.

The History of Private Currency and the Lead Up to Bitcoin

Importantly, it is not just the cypherpunks who saw the promise in the separation of State and money. Former Federal Reserve chairman Alan Greenspan knew of the history of private money and envisioned technology re-opening the doors to private money in the near future in a 1996 speech at the U.S. Treasury Conference of Electronic Money & Banking: The Role of Government. In the speech, given on September 19, 1996, Greenspan concisely summarized some of the history of privately issued money in the United States:

Throughout much of the 19th century, privately issued bank notes were an important form of money in our economy. In the pre-Civil War period, in particular, the federal government did not supply a significant portion of the nation’s currency. The charter of the Bank of the United States had not been renewed, and there was no central banking organization to help regulate the supply of currency. Notes issued by state-chartered banks were a major part of the money supply. This was a result, in large part, of the “free banking” movement, a period when state chartering restrictions on banks were significantly loosened. Free banking dominated the landscape in most of the states in the Union starting in the 1830s, and lasted until the National Banking Act was adopted in 1863.

The free banking period was a controversial one in U.S. history. The traditional view has been that this period gave rise to “wildcat banking,” in which banks were created simply to issue worthless notes to an unsuspecting public who would seek in vain among the “wildcats” for redemption in specie. Non-par clearing of bank notes, along with suspension of specie payments by banks and outright defaults, did lead to risks and inefficiencies.

But more recently, some scholars have suggested that the problems of the free banking period were exaggerated. Retrospective analyses have shown, for example, that losses to bank note holders and bank failures were not out of line with other comparable periods in U.S. banking history.

The newer research also suggests that, to a degree, the problems of free banking had little to do with banking. In particular, although free banking laws varied considerably by state, issuers of bank notes were often required to purchase state government bonds to back the notes they issued. In some cases, these securities were valued at par rather than at market prices–a structure that evidently did foster wildcat banking. Moreover, no matter what the regulatory valuation scheme, when the state government ran into financial problems, as many often did, both the bonds and the bank notes sank in value. In some cases, this contributed to bank failures.

Few people know that there is a long history of private money in the United States. Therefore, the idea of private money is not a novel feature of Bitcoin. With the advances in technology, Greenspan believed some sort of digital cash was inevitable. Later in the speech Greenspan went on to state:

…We could envisage proposal in the near future for issuers of electronic payment obligations, such as stored-value cards or ‘digital cash,’ to set up specialized issuing corporations with strong balance sheets and public credit ratings. Such structures have been common in other areas, for example, in the derivatives and commercial paper markets.

In conclusion, electronic money is likely to spread only gradually and play a much smaller role in our economy than private currency did historically. Nonetheless, the earlier period afford certain insights on the way markets behaved when government rules were much less pervasive. These insights, I submit, should be considered carefully as we endeavor to understand and engage the new private currency markets of the twenty-first century.

One of the things the last several years has taught us is that there are no irrefutable experts when it comes to abstract, non-static, evolving fields like medicine (e.g. the bungling of COVID), economics, and currency (e.g. inflation is transitory). However, Greenspan’s 1996 speech provides a good history lesson of how private currency once operated in the United States and the pivotal role it played in pre-civil war banking. Today, many people ignorantly dismiss the idea of separating the currency from the governmental authority. This is short sided. Greenspan’s insight and thoughts about the future of money are not the only misunderstood items. Many people who easily dismiss Bitcoin are unaware of the numerous failures that created innovations that were eventually incorporated into the Bitcoin protocol.

The idea of a digital form of cash was not what made Bitcoin such a novel idea. For example, Digicash, which was one of the first major digital currency projects, was started in 1989 by David Chaum. Digicash innovated a method for digital transactions to occur anonymously through the use of public and private key cryptography. The purpose of Digicash was to allow users to conduct online transactions with complete privacy. Digicash, which was used exclusively by the banking system and existed before the prevalence of online purchases that are ubiquitous today, eventually filed for chapter 11 bankruptcy in 2002.

Adam Back, a British cryptographer, came up with the idea of Hashcash in 1997. Hashcash created the concept of proof-of-work which allowed individuals to generate new Hashcash by solving complicated mathematical formulas. The formulas utilized to generate the new Hashcash were so complicated that computers were left to guess at the inputs that would generate the correct answers to allow the computers to mint the new Hashcash. However, Hashcash eventually failed because, among other reasons, once the Hashcash was generated it could only be used once so new units needed to be created any time a user wanted to spend the Hashcash. Additionally, an individual with enough computing power could inflate the supply of Hashcash which reduced the value of each unit of Hashcash.

In 1998 Nick Szabo improved upon Back’s Hashcash when he theorized about a project he called Bit Gold. Bit Gold was one of the earliest attempts to create a digital currency without a trusted third party. Similar to Hashcash, Bit Gold used the proof-of-work concept, along with time-stamps and a title registry that would store the transaction history through the use of nodes (individual computers participating in the network) that made up the decentralized, distributed system in lieu of a trusted third party (e.g. a bank). Unlike Hashcash, Bit Gold could be reused which made it a more useful system. While the project was never formally launched, it was known and discussed among cryptographers.

These projects along with many others provided useful guidance in the creation of the Bitcoin protocol. The Bitcoin protocol was the first to successfully incorporate the various ideas from the previous failures that tried to bring the idea of a decentralized electronic system of cash to fruition. The Bitcoin protocol incorporates the ideas of pioneers in technology and cryptography to create the synergy for Bitcoin.

It was only after decades of incremental improvements to technology and cryptography that the Bitcoin protocol was possible. On October 31, 2008, Satoshi Nakamoto (a pseudonymous person), released the Bitcoin whitepaper on a cryptography mailing list. The next part of the paper will explore the basics of Bitcoin before returning to the question of what makes bitcoin unique compared to the thousands of other cryptocurrencies that have flooded the system since Bitcoin’s creation.

The Basics of Bitcoin

The original goal of Bitcoin as stated in the whitepaper was to create a peer-to-peer version of electronic cash that would allow payments to be sent directly from one party to another without the need of any financial institution. Instead of a trusted third-party, Bitcoin is controlled by its distributed ledger and the nodes that verify the transactions of the blocks. As a result, Bitcoin is decentralized and allows its users to transact business without any trusted third party (such as a bank or government).

The supply of bitcoin is limited to 21 million bitcoin (when the B in Bitcoin is capitalized it is a reference to the software and protocol, when the B is lowercase it is a reference to the unit of currency). Each bitcoin consists of a smaller denomination called a satoshi. One bitcoin has 100,000,000 satoshis. A block is mined (i.e. created) approximately every 10 minutes based on a mathematical formula using a concept known as proof-of-work.

The proof-of-work system the Bitcoin protocol uses is important to grasp so one can conceptualize the security of the Bitcoin protocol despite being completely decentralized. To understand how Bitcoin mining works the concept of a hash function is critical. A hash function is a computer program which transforms any kind of data of any length to a fixed number of characters. There are many different hashing algorithms that have been created. However, the Bitcoin protocol uses the hashing algorithm known as Secure Hash Algorithm 256 (SHA256) (technically the Bitcoin protocol uses double SHA256 which means data is put into the hash function two times. Satoshi’s reason for this is a mystery and it is not particularly pertinent to this article). SHA 256 provides a fixed length output of 64 characters using only the hexadecimal numbers (0, 1, 2, 3, 4, 5, 6, 7, 8, 9, a, b, c, d, e, and f). The hexadecimal number system is frequently used in computer science because it allows 4 bits of data to be used efficiently which is always one of the paramount goals for programming.

A useful hash function has the following five characteristics:

- The hash function creates a hash value on any length of data quickly;

- The hash function is deterministic. This means the hash function always creates the same hash value (output) for the same input;

- The hash function is pseudorandom. This means the hash value returned should change unpredictably when the input of data is changed, even if the change is slight. However, a hash function is only pseudorandom because an identical entry should always produce the same hash value (i.e. it is deterministic);

- The hash function is preimage resistant. This means the input cannot be calculated or determined based on the hash value. In other words, the hash function only works in one direction from input to output. Under no circumstances should a person or even the strongest super computer be able to determine the input of a useful hash function from the hash value; and

- The hash function is collision resistant. This means there is only one input that creates a hash value. If there are two inputs that create the same hash value, the hash function is not collision resistant.

One of the ways the Bitcoin protocol uses a hash function is to mine a new block. A new block is mined when a miner inputs a block header that has a hash value that is lesser than or equal to the target hash. While the granular details are beyond the scope of this paper, exploring some of the details is necessary particularly in light of the current DOL guidance of using “extreme care” when examining cryptocurrencies. Importantly, there are some items of the block header that the Bitcoin miner does not have the discretion to change and other parts the Bitcoin miner has the discretion to change. This is important because each block header is unique making each problem the miner needs to solve different than previous blocks. As a result, past solutions or past guesses do not assist miners in mining new blocks. Rather, each block creates a new problem that must be solved from scratch.

In the previous paragraph we established that miners earn the right to mine a block, if the miner inputs a block header that produces a hash value that is less than the target hash value. The next important question is what is the makeup of a block header. A block header consists of exactly 80 bytes of data (1 byte is made up of 8 bits. A bit is the binary code of 0s and 1s that are the smallest measurement of data). The block header consists of these items in the following order:

- The version. This field which is 4 bytes in size dictates the block validation rules to follow. While this field could change when the Bitcoin protocol undergoes changes (something that does not occur frequently), this will be a static field for day-to-day mining.

- The previous block’s header hash. This field, which is 32 bytes, represents the hash value of the previous block’s header. This is what creates the blockchain as all the blocks point back to the previous block. A miner has no control of this part of the input as it is solely dictated by the previous block. Every miner attempting to mine the next block will have an identical first 36 bytes for the block header. However, each new block that is mined will have a unique 32 bytes associated with the previous block’s header as the SHA256 hashing algorithm is collision resistant. Consequently, each new block that is mined creates a different problem that miners must solve.

- Transaction of the current block. A Bitcoin block will include transactions transferring bitcoin between the network’s users. The Bitcoin protocol limits the block size to 1 megabyte. While the number of transactions can vary from block to block there are approximately 2,000 transactions per block. The Bitcoin protocol utilizes a Merkle tree to represent these transactions using the SHA256 hashing algorithm for each transaction in the block. The bottom level of the Merkle tree pairs transactions together and then runs the input through the hashing function to create a new single hash value. If there are an odd number of transactions on the block, one transaction is placed into the hashing algorithm twice. This is done repeatedly until all of the transactions in the block create a 32 bytes hash value. The single 32 bytes hash value is known as a Merkle root (this videodoes a great job of explaining these concepts for visual learners). Miners have discretion to change the transactions in the block. As a result, any single transaction being changed will necessarily change the Merkle root. Consequently, miners have discretion over this input. However, miners have an incentive to pick the transactions which have the greatest fees associated with them.

- The timestamp. This field represents 4 bytes of data. The time stamp provides an approximate time of the creation of the block. The time is measured from the time the miner started to attempt to mine the block.

- The difficulty target. This field represents 4 bytes of data and measures the difficulty target of the block.

- The nonce. The word nonce is an abbreviation for number only used once. This field represents 4 bytes of data which the miner has full discretion for the input. The miner is attempting to produce a hash value that is lower than the hash target.

All of these items make up the block header which is then placed into the hash function. As currently constructed, there are 2 to the 96th power nonces available for bitcoin miners to select given the items the miner has the discretion to change in the block header. That number is an eight followed by 28 zeros.

One of the key features of the Bitcoin protocol was Satoshi’s foresight of adjusting the difficulty of the hash function. Every 2016 blocks (which approximately equates to every two weeks) the difficulty to the hash function is changed to reflect the number of miners trying to generate new blocks and the technological improvements miners are continually making. The difficulty of the hash function is measured by the number of leading zeros required for the target hash. If more miners are participating or the equipment being used by miners is generating more attempts to guess the hash value, the hash function is made more difficult to solve. However, if fewer miners are participating and the miners are generating fewer attempts to guess the hash value, the hash function is made easier to solve. The goal of the difficulty adjustment is to have the new blocks generated approximately every 10 minutes.

At the time of this publication, the target hash requires 19 leading zeros for a miner to win the right to mine the block! However, if a miner discovers a hash with more than 19 leading zeros, the miner will still win the right to mine the block. Interestingly, the block that was mined with the most leading zeros to date was Bitcoin block 634,842 which had an astounding 23 leading zeros and produced the hexadecimal hash value of 000000000000000000000003681c2df35533c9578fb6aace040b0dfe0d446413 (one can see that the hash value consists of nothing but the hexadecimal number of 0, 1, 2, 3, 4, 5, 6, 7, 8, 9, a, b, c, d, e, and f). It is the only block to ever have 23 or more leading zeros! As of February 28, 2024, Bitcoin’s hash rate is 524,000,000 terahashes per second (TH/s). In other words, currently miners are inputting 524,000,000,000,000,000,000 nonces (or guesses for a layman) per second to attempt to mine the next Bitcoin block!

Each block contains transactions transferring bitcoin among its users based on wallet addresses. The miner of a block is rewarded with bitcoin (known as the block reward) plus the transaction fees for the transactions the block contains. The block reward started at 50 bitcoins per block mined. However, the block reward is cut in half approximately every four years. This is referred to as a halving (or some people refer to it as a halvening). Bitcoin has undergone three halvings since its inception. The current block reward is 6.25 bitcoin but the next halving is going to occur in April 2024 at which time the block reward will be cut in half to 3.125 bitcoin. The last bitcoin is scheduled to be mined around 2140 at which point miners will be paid solely through transaction costs. Unlike the supply of the monetary systems operated by governments, which are controlled solely by a few people working for the central bank, the supply of bitcoin is already known based on the halving cycles. To many this is an appealing feature of the Bitcoin protocol.

While understanding the bitcoin mining process can be overwhelming, it is important to understand because it highlights the security of the Bitcoin protocol. As a result of the Bitcoin hash function randomly generating numbers, the chances of one leading zero can be thought of as a 1 in 16 chance or a 6.25 percent chance. The chances of the first two hexadecimal numbers being a leading zero would be 0.39 percent (0.0625 * 0.0625 = 0.0039). With each hexadecimal number having a 1/16 chance of being zero this calculation can be performed using the number of zeros required to generate the target hash value. The lowest number of leading zeros ever required to mine a bitcoin was 8 leading zeros. The odds of generating a hash value with eight leading zeros is 0.00000002 percent. As mentioned above, the current difficulty level for bitcoin miners requires 19 or more leading zeros in the hexadecimal hash value. The odds of generating a hash value with 19 leading zeros is 0.000000000000000000001 percent (that is 1 preceded by 20 zeros). The computing power that secures the Bitcoin network is hard to fathom. As a result of the computing power, the Bitcoin network has never been hacked and it has created the most secure computing system that has ever existed.

Once a block has been successfully mined the mining node transmits the block to all of its peers. A node is a computer or server that is running the Bitcoin protocol software. The nodes are interconnected and combined the nodes form a decentralized network. The fact that the Bitcoin network is decentralized is one of the hallmark features of the Bitcoin technology. As a result of the Bitcoin network being decentralized, there is no central authority that controls the decisions of the network and, importantly, there is no single point of failure.

Instead, the Bitcoin network is controlled by its network of nodes. While the number of nodes operating on the system is unknown for a variety of reasons, there are more than 10,000 reachable nodes operating world-wide. The nodes form a network and, among other things, transfer information regarding blocks and other data such as software updates. The nodes across the network validate the block and spread the news of the newly mined block across the decentralized network. If a miner is dishonest with regard to the block it mined, the nodes will reject the block so there is only an incentive to publicize blocks that have actually found a nonce and awarded themselves the proper bitcoin reward (currently 6.25 bitcoin per block mined plus the transaction fees) that meets the target hash value criteria.

Once a node receives news of a new block has been mined it validates that block by checking the contents of the block against a list of criteria which all must be met or else the block is rejected. Some of the items the nodes check to confirm the block are:

- The block structure is syntactically valid;

- The hash value of the block header is less than the target hash;

- The block timestamp is less than two hours into the future (the two hour time distance allows for an ample amount of leeway);

- The block size does not exceed the 1MB limit; and

- The block reward provided to the winning miner is correct.

If, and only if, all the criteria listed above and some other criteria that are beyond the scope of this paper are met, will the node attempt to add the block to the existing blockchain. The node will try to place the new block on top of the parent block by looking for the previous block’s hash header. Once the node confirms the new block is authentic, the node will communicate the block to other nodes. Eventually every node throughout the system will become aware of the new block.

It is possible that different miners find a hash value that meets the criteria of the target hash at or close to the same time. In that circumstance, each miner will publicize its solution to the nodes in the system. The Bitcoin protocol states that the chain with the greatest difficulty will be the winner. Temporary discrepancies in separate chains that have separate blocks are resolved when the nodes select to extend one of the chains with the next mining block. Once a block is six blocks removed from the top of the block chain (in other words six blocks have been mined after the block in question), the block is considered immutable on the blockchain.

Admittedly, that was a lot of information. However, we strongly believe that everyone needs to have an understanding of the background and basics of Bitcoin before understanding why Bitcoin is next to impossible to replicate in the future and that lumping it together with other cryptocurrencies is short-sided at best, if not all together ignorant. The next section details what makes Bitcoin so unique compared to the other thousands of cryptocurrencies.

Bitcoin is Not Comparable to Any Other Cryptocurrency

One thing that makes Bitcoin stand-alone compared to other cryptocurrencies is its inception story. Bitcoin was created by the pseudonymous person or persons Satoshi Nakamoto. Satoshi was involved in the development of Bitcoin in the early days and was responsible for mining many of the initial blocks. It is hard to extract the exact number of bitcoin Satoshi accumulated from early Bitcoin mining. However, a thorough analysis performed by Sergio Lerner, a cryptocurrency researcher, reviewed the first 36,200 blocks mined during the Bitcoin protocols first 13 months of existence. Using data from the genesis block (the first block in the Bitcoin blockchain which the research presumes was mined by Satoshi), Lerner discovered that 1,125,150 bitcoins were mined from a single mining setup. These bitcoins are scattered across thousands of wallets. At the current price on February 28, 2024 of roughly $61,000 per bitcoin, Satoshi’s bitcoin is worth $68 billion based on Lerner’s research.

While Satoshi’s wealth accumulated through bitcoin is staggering, the more interesting thing is Satoshi’s coins have never moved for a profit motive! Additionally, in April 2011 Satoshi disappeared and has not been heard from since, after stating he was moving on to other projects. While Satoshi was involved in the early days of Bitcoin, since its inception the Bitcoin protocol has been run by the nodes that verify the network. Satoshi’s disappearance and apparent unwillingness to cash in the staggering wealth he earned from his innovation is one of the items that makes bitcoin distinct from all other crypto projects. Satoshi had the altruistic motive of improving upon the monetary system that fails so much of the world’s population and creating an electronic cash system that could operate without a trusted third party.

Bitcoin is truly decentralized and has no employees or known founder. Bitcoin is solely operated under a set of rules administered by the nodes instead of the whims of a founder or those who hold a large amount of that particular cryptocurrency. Unlike the majority of the thousands of cryptocurrency projects that have launched since Bitcoin, Bitcoin was not created to benefit its founder or the insiders rather Bitcoin was launched for the altruistic reason of improving upon the world’s monetary system for the good of the human population. It is hard to fathom another project having a fairer start than the launch of Bitcoin because of the greed pervasive in today’s society.

The Bitcoin protocol has been so successful that during the 2021 bull run the price of a single bitcoin was more than $69,000. When the price of bitcoin surpassed $54,000 bitcoin’s market cap exceeded the $1 trillion threshold for the first time only 12 years after its creation! Bitcoin’s market cap plummeted during the most recent bear market which hit rock bottom with the collapse of FTX. However, with the steep rise in bitcoin’s price recently it reclaimed its $1 trillion market cap! The next closest cryptocurrency in terms of market cap is Ethereum which has a market cap of roughly $390 billion. However, the market cap of the most valuable cryptocurrencies quickly diminishes as an individual goes further down the list as the cryptocurrency with the tenth highest market cap is Dogecoin with a market cap of $14 billion. Bitcoin’s dominance and prevalence in the space cannot be overstated.

While Bitcoin is not a company and, perhaps, could more fairly be represented as a social project, compared to other companies, bitcoin became the fastest company (or project) to have a market cap surpass $1 trillion! The next closest in speed for a company to have its market cap surpass the $1 trillion benchmark was Google. It took Google almost twice as long, 21 years. It took Amazon 24 years, Apple 42 years, and Microsoft 44 years! Yet here we are debating whether Bitcoin is responsible for a fiduciary to add to a 401(k) investment menu?

For similar projects, it took an even more staggering amount of time to meet the benchmark. Take gold for instance (I guess gold was a passion project for God (or the creator if that’s more your speed)), gold did not surpass the $1 trillion market cap until 2009. That’s a staggering 4.5 billion years to surpass the trillion dollar market cap! Yes, it is easy to manipulate numbers, but the comparison to other companies, particularly technology companies, appears appropriate. An insightful article discussed the history of companies who would have previously surpassed the $1 trillion benchmark valued in today’s dollars.

While entities like the ones listed in the linked article above had technologies caving in on them that would make their once lucrative business obsolete or half the world’s population fighting against its entire industry, a whole new world of technologies is coming into the palm of the world’s populations’ hand. Drawing the conclusion that these technologies should only increase the use cases for Bitcoin and increase its value in the future does not seem far-fetched particularly in light of the fact that bitcoin has been the most asymmetric bet an investor could have made a decade ago. Is that type of sustained growth possible, of course not. The price was $12 per bitcoin in November 2012 and it is approximately at $20,000 in October 2022 (note these were the dates and prices used for the original publication of this article). That’s a 170,000 percent return. At that rate the value of a single bitcoin in 2032 would exceed $34 million. I don’t know anyone that is that optimistic. But could bitcoin’s market cap surpass gold’s $10 trillion market cap within the next decade or possibly sooner? Many have predicted just that to happen! That would put the price of a single bitcoin at $500,000.

Yes, since those all-time highs the bitcoin market fell significantly, dropping all the way to $17,000 before recovering and hovering around $20,000 for four months until the FTX fiasco sent the price of bitcoin plummeting to $15,645. However, this is a trend seen repeatedly throughout Bitcoin’s history. To date, the bitcoin price has always recovered and moved onward and upward. As we discussed in the previous section, the reward a miner receives for mining a block is cut in half every four years. A miner reward, sometimes referred to as the block reward, for mining a block started at 50 bitcoin. However, this block reward was cut to 25 bitcoin on November 28, 2012. The block reward was cut to 12.5 bitcoin on July 9, 2016 and then again to 6.25 bitcoin on May 11, 2020. After the next halving, which is predicted to occur on April 18, 2024, the block reward will be 3.125 bitcoin. The bitcoin halvings have created a phenomenon known as the bitcoin market cycle.

While the price of bitcoin has certainly fallen significantly since its all-time high, it is perhaps best to view bitcoin through the lens of the four-year halving cycles when analyzing the price fluctuations. The chart below looks at the price lows and highs during each four-year cycle.

|

Period |

Low Price | High Price |

|

01/03/2009 – 11/28/2012 |

$0 |

$31.90 |

|

11/29/2012 – 07/09/2016 |

$12.40 |

$1,241.90 |

|

07/10/2016 – 5/11/2020 |

$471.40 |

$19,870.60 |

| 05/12/2020 – present | $8,865.30 |

$68,990.60 |

While there are only four data points for lows and highs as a result of three halvings occurring to date, the pattern is higher lows and higher highs with each successive halving. This is in part due to the supply being cut in half with the halving (hence the name) but also due to bitcoin being owned by more and more individuals around the globe. The halving of the supply every four years along with the continued adoption as more and more utilities for Bitcoin have come to fruition has led to a continued increase in the price with each halving despite the price of bitcoin falling dramatically during the bear market portions of the four-year cycles. Studying the four year cycles centered around the halving events provides fiduciaries useful information.

The chart below, which is based on the monthly lows and highs of bitcoin, illustrates the lows and highs during the calendar years since bitcoin’s inception:

| Year | Low Price | High Price |

| 2010 | $ – | $ 0.50 |

| 2011 | $ 0.30 | $ 31.90 |

| 2012 (halving) | $ 3.90 | $ 15.40 |

| 2013 | $ 13.20 | $ 1,241.90 |

| 2014 | $ 91.70 | $ 1,093.40 |

| 2015 | $ 157.30 | $ 492.80 |

| 2016 (halving) | $ 350.40 | $ 982.60 |

| 2017 | $ 739.50 | $ 19,870.60 |

| 2018 | $ 3,177.00 | $ 17,252.80 |

| 2019 | $ 4,070.50 | $ 13,929.80 |

| 2020 (halving) | $ 3,869.50 | $ 29,298.80 |

| 2021 | $ 28,204.50 | $ 68,990.60 |

| 2022 | $ 15,645.90 | $ 48,199.00 |

| 2023 | $16,625.08 | $43,714.90 |

| 2024 | $39,521.50 | $63,718.50 |

The price of bitcoin has been extremely volatile throughout bitcoin’s history. However, the price of bitcoin has increased exponentially with each halving. When looking at the price of bitcoin following the day-to-day fluctuation is a fool’s errand. One could argue a more prudent way to examine the price is based on the Bitcoin protocol’s scheduled halving cycles.

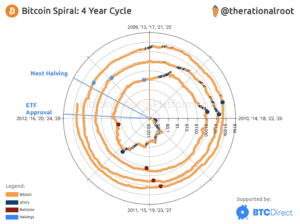

One interesting way people have begun viewing the halving cycles is in terms of a clock. A halving occurs approximately every 4 years ((210,000 blocks 10 minutes)/(365.25 days 24 hours * 60 minutes) = 3.99 years). Every 52,500 blocks would represent approximately one year of the four-year halving cycle. The next halving is scheduled to occur on April 18, 2024. Viewing the halving cycles as a clock provides myriad interesting insights as the chart below illustrates.

The orange line on the chart represents the price of bitcoin and each circle represents bitcoin’s price denominated in United States dollars starting at $0.001 and growing by a 10x multiple all the way to $1,000,000 at the outermost circle.

The light blue dots on the chart represent the three halvings that have occurred to date while the dark blue dots on the chart represent the price of bitcoin reaching an all-time high. At Bitcoin’s inception, before a halving even occurred (which could be referenced as the genesis cycle), the price of bitcoin reached an all-time high in each of the first three years of the genesis cycle. However, discounting the genesis cycle appears appropriate as Bitcoin was truly in its infancy and no supply shock had been introduced into the system.

After the first halving, which occurred on November 28, 2012, the price of bitcoin reached an all-time high within the first year of the halving cycle. The price of bitcoin continued to fluctuate until it surpassed its previous all-time high in the second year of the halving cycle. The bottom of the second halving cycle, which is marked by the red dots in each cycle on the chart above, came in the third year of the halving cycle

After the second halving, which occurred on July 9, 2016, the price of bitcoin reached an all-time high at the end of the first year of the new cycle and again in the first half of the second year. The second halving cycle’s all-time high was achieved almost exactly halfway through the second year of the halving cycle. The bottom of the second halving cycle occurred almost exactly halfway through the third year of the halving cycle.

After the third halving, which occurred on May 11, 2020 and is the current halving cycle, the price of bitcoin reached an all-time high in the second half of the first year. The third halving cycle’s all-time high, just like the second halving cycle’s all-time high, was achieved almost exactly halfway through the second year of the halving cycle! And, just like the bottom of the second halving cycle, the bottom of the third halving cycle, at least to date, occurred almost exactly halfway through the third year of the halving cycle.

There is a trend for bitcoin to reach an all-time high within the first 78,750 blocks of a new halving cycle. In fact, it is almost precisely at that point, 78,750 blocks into a new halving cycle, that bitcoin has reached its all-time high for that particular cycle. Similarly, the halving cycle lows of the past two cycles are each roughly 131,250 blocks in to the new halving cycle.

Another interesting and more poignant insight the chart provides is the line representing the bitcoin price never intersects anywhere in the chart. In other words, the price of bitcoin has never been less at that specific point in the halving cycle compared to the previous halving cycle. The spiral has only grown outward. Will that continue until the final block reward is paid out in 2140? I’m skeptical. However, it would not be a surprise to see this trend continue for several more halving cycles as Bitcoin continues to become intertwined with the world’s economy. To the contrary, it can be said with 100 percent confidence that the value of a dollar today will be less in one year (let alone four years) due to the Federal Reserves stated 2 percent annual inflation goal.

Bitcoin is quickly approaching its fourth halving event. If history is any indicator, this has been a good time to buy bitcoin. Admittedly, Bitcoin has never existed during a recession which could be looming over the world economy although those fears have been wrong for over a year now. It is easy to get caught up in the day-to-day volatile swings of the price of bitcoin and the mainstream media’s sensationalized claims that Bitcoin has died (476 times and counting), but viewed through the lens of the halving cycles, a pattern may be emerging. A sound strategy may be to allocate a small percentage of one’s portfolio to bitcoin and then forget about it for two halving cycles without following the predictable price fluctuation that occurs over the short-term.

Even if a plan fiduciary is not ready to make bitcoin available to plan participants or place on a pension fund’s balance sheet, it is time for all plan fiduciaries to have a deep understanding of Bitcoin’s fundamental properties. One question that plan fiduciaries should ponder is: If this market cycle is not the right time for plan participants and plans to invest in bitcoin, how many more successful market cycles are needed?

I would highly encourage those who are interested in learning more about the Bitcoin halving cycle phenomenon to watch this insightful, concise presentation by @therationalroot from the 2023 Bitcoin Conference.

As the Price of Bitcoin Plummeted Bitcoin’s Hash Rate Reached All-Time Hights

Even when the bitcoin price fell off a cliff, the hash rate (the number of guesses the miners are making per second) was at an all-time high a trend which has continued with the sharp rise in bitcoin’s price. The all-time high in hash rate comes in spite of China “banning” mining in 2021. This caused many miners to move out of China to more Bitcoin friendly jurisdictions. Despite China’s notorious draconian enforcement of its laws, only the United States exceeded China as far as contributions to the Bitcoin mining network for the period of September 2021 to January 2022 after China banned Bitcoin mining! It has not, and it will not, be easy for any government to shut down or ban the Bitcoin network.

The hash rate being near an all-time high means the Bitcoin network is as secure as ever despite having no trusted third party. For those who have read the Bitcoin white paper, the mathematics explaining the Bitcoin Network’s security is rather daunting. However, the math explained in plain English, a task successfully accomplished by a paper titled Satoshi’s White Paper – the Hard Part Explained is insightful.

One problem Satoshi solved was the double spend problem or the Byzantine generals problem as it is more commonly referred to in computer science. This problem stated most succinctly is to make sure an individual cannot spend his/her money (or in this case) bitcoin twice. Before Satoshi released the Bitcoin white paper, the double spend problem had been one of the primary hurdles that had thwarted computer scientists’ goal of creating a private, digital money. While Satoshi did not solve the problem definitively, he did create a solution that solved the problem to allow the users of the Bitcoin network to successfully utilize the network with close to mathematical certainty that the double spend problem would not be an issue.

As we discussed previously in the paper, the way the Bitcoin network determines which chain among contradicting chains is the correct chain is looking for the longest chain (which will have the most computer power associated with it). If a person is wishing to attack the longest chain, the attacker will need to create a new, longer chain with different transactions to cause the double spend scenario to occur. For the attack to be successful the attacker could have the ability to have certain transactions in the new, longer chain that send coins to alternative addresses than was reflected in what the Bitcoin network previously deemed to be the longest chain. However, the attacker will only be able to intentionally “double spend” coins the attacker or an accomplice has under control and the attacker’s new chain will have to go back to the blocks it wants to change. This requires a staggering amount of computing power and would be extremely expensive.

In section 11 of the Bitcoin white paper, Satoshi discusses the mathematics of an attacker with 10 percent control of the Bitcoin mining network and 30 percent control. Let’s review the numbers using the more extreme example of an attacker having 30 percent of the Bitcoin network’s computing power. In this scenario, an attacker who wishes to attack the network with a block 15 blocks prior in the blockchain (2.5 hours approximately in blockchain time – 15 blocks * 10 minutes = 150 minutes) will only have a 1 percent chance at success. However, the miner with nefarious intention will be foregoing the opportunity to mine the next block which the miner would have a 30 percent chance of achieving. As discussed previously, miners are currently rewarded 6.25 bitcoin plus the transaction fees associated with the block. A nefarious miner with 30 percent of the computing power of the Bitcoin network attempting to change transactions 24 or more blocks prior to the current block would have a less than a 1 in 1,000 chance of a successful attack.

Section 11 of the white paper includes a chart which shows how many blocks down it would take for a nefarious miner to have less than a 1 in 1,000 chance of a successful attack based on the nefarious miner having an assumed share of the Bitcoin network’s computing power.

|

A Nefarious Miner Has Less than a 1 in 1,000 Chance of a Successful Attack |

|

|

Bitcoin Mining Power |

Number of Blocks |

|

0.1 |

5 |

| 0.15 |

8 |

| 0.2 |

11 |

|

0.25 |

15 |

|

0.3 |

24 |

| 0.35 |

41 |

| 0.4 |

89 |

| 0.45 |

340 |

As the chart above displays, as the nefarious miner’s share of the Bitcoin network’s computing power rises, the number of blocks the miner can attack with less than a 1 in 1,000 chance of success rises. However, garnering that much control of the Bitcoin network hash rate is hard to fathom given the competitive, decentralized nature of mining and the hash rate continuing to rise in a fashion that has been uncorrelated to Bitcoin’s price.

While the Bitcoin network has never had a successful 51 percent attack performed against it, other cryptocurrencies have been impacted by such attacks. Ethereum classic was successfully attacked in 2019 and Bitcoin Gold was successfully attacked in 2018. However, the hash rate of the Bitcoin network is exponentially higher than any other cryptocurrency utilizing a proof-of-work system. On February 28, 2024 DOGE, the proof-of-work cryptocurrency with the second highest market cap, $15.1 billion, had a hash rate of 969.38 TH/s while Litecoin, another proof-of-work cryptocurrency that has been around since 2011, had a hash rate of 968.01 TH/s. As mentioned above, the Bitcoin network’s hash rate as of February 28, 2024 was 524,000,000 TH/s. Bitcoin’s hash rate is exponentially larger than these and all other cryptocurrencies. This ensures the security of the Bitcoin network and allows users to confidently transact using bitcoin without the fear of a 51 percent attack.

Conclusion

The concept of private money is not a new concept to the American financial system. The technology that helped create Bitcoin developed after decades of hard work and failures of other projects. Bitcoin allows its users to participate in an electronic form of cash without the need for a trusted third party. Unlike currencies offered through governments, Bitcoin follows a fixed set of rules (supply, how the currency is distributed, halving schedules, etc.) which is regulated solely by the nodes operating on the Bitcoin network rather than the whims of a few people making the decisions for the government’s central bank.

The Bitcoin mining process is cumbersome to understand. One of the goals of this paper was to allow the readers to understand some of the basics surrounding the technologies the Bitcoin network uses to secure the system. If nothing else, seeing the number of guesses miners make per second should astonish everyone. While it is not imperative for everyone to understand the most granular details of Bitcoin, the history of the technology shows us the mathematics and computer science the Bitcoin technology was built upon is a reliable alternative to explore.

Bitcoin’s inception story is unique compared to all other cryptocurrencies that have entered the ecosystem since Bitcoin’s creation. Satoshi disappeared in 2011 leaving the Bitcoin project in the hands of other developers. Astonishingly, the more than 1 million bitcoin Satoshi mined in the early days of Bitcoin have never moved for a profit motive. While altruism is in short supply in today’s society, particularly in the cryptocurrency ecosystem, Satoshi appeared to have altruistic motives of improving upon the global monetary system when he released the Bitcoin whitepaper. Bitcoin has already reached the heights very few companies have achieved in the history of the world and it appears poised to start another bull run with the fourth halving set to occur on April 18, 2024. While the price has come crashing down many times throughout Bitcoin’s history, the price has always recovered. Additionally, despite these price crashes, the health of the Bitcoin network remained strong and secure as the hash rate continues to rise even when the price dips. All of these items make Bitcoin unique compared to other cryptocurrencies.

While skeptics will continue to exist, there are myriad reasons to believe the bull runs will continue with each halving (at least for a few more cycles). On January 10, 2024 the SEC approved the first spot Bitcoin ETFs. To say the launch of the Bitcoin ETFs has been a success would be an understatement as the spot Bitcoin EFTs continue to break ETF records. There is strong evidence to support the view that more institutional players will continue to enter the Bitcoin ecosystem as we approach the fourth halving which could produce prices that few could even fathom. How high could the price of bitcoin go during the fourth halving cycle? We will leave that to others to pontificate. However, a quote from Michael Jordan’s hall of fame speech sums up our view concisely “…limits like fears are often just an illusion.” The price of bitcoin has epitomized that phrase throughout its history.