This is one article in a collection of 52 articles published weekly throughout 2023 on the basics of Bitcoin. The series is intended for people unfamiliar with Bitcoin or people wishing to enhance their understanding of the fundamentals that underpin the technology. Please contact us, if you have any questions or comments.

In April 2024, the fourth Bitcoin halving will occur. The halving means that the portion of the block reward that is a fixed number of bitcoin a successful miner receives for their work will be cut in half. Currently, a successful miner receives 6.25 bitcoin for each block it mines plus the amount of transaction fees associated with the block. The fixed number of bitcoin a miner who successfully mines a block will receive after the next halving will be 3.125.

A Bitcoin halving occurs every 210,000 blocks. A block is mined approximately every 10 minutes and the Bitcoin protocol assures the blocks are mined approximately every 10 minutes by adjusting the difficulty of the hash rate every 2,016 blocks. The difficulty adjustment moves the target hash up or down depending on how fast the previous 2,015 blocks were created which is strongly correlated to the hashing power being used over that time period.

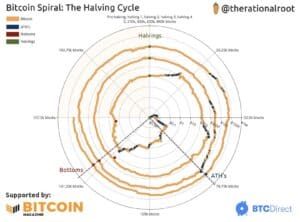

One interesting way people have begun viewing the halving cycles is in terms of a clock. A halving occurs approximately every 4 years ((210,000 blocks * 10 minutes)/(365.25 days * 24 hours * 60 minutes) = 3.99 years). Every 52,500 blocks would represent approximately one year of the four-year halving cycle. The next halving is scheduled to occur on April 15, 2024. Viewing the halving cycles as a clock provides myriad interesting insights as the chart below illustrates.

The top of the clock, where a 12 would be on a typical clock, represents the point where the halving occurs. This represents a reset in the halving cycle and the count towards the next 210,000 blocks begins. The orange line on the chart represents the price of bitcoin and each circle represents bitcoin’s price denominated in United States dollars starting at $0.001 and growing by a 10x multiple all the way to $1,000,000 at the outermost circle.

The blue dots on the chart represent the price of bitcoin reaching an all-time high. At Bitcoin’s inception, before a halving even occurred (which could be referenced as the genesis cycle), the price of bitcoin reached an all-time high in each of the first three years of the genesis cycle. However, discounting the genesis cycle appears appropriate as Bitcoin was truly in its infancy and no supply shock had been introduced into the system.

After the first halving, which occurred on November 28, 2012, the price of bitcoin reached an all-time high within the first year of the halving cycle. The price of bitcoin continued to fluctuate until it surpassed its previous all-time high in the second year of the halving cycle. The bottom of the second halving cycle, which is marked by the red dots in each cycle on the chart above, came in the third year of the halving cycle

After the second halving, which occurred on July 9, 2016, the price of bitcoin reached an all-time high at the end of the first year of the new cycle and again in the first half of the second year. The second halving cycle’s all-time high was achieved almost exactly halfway through the second year of the halving cycle. The bottom of the second halving cycle occurred almost exactly halfway through the third year of the halving cycle.

After the third halving, which occurred on May 11, 2020 and is the current halving cycle, the price of bitcoin reached an all-time high in the second half of the first year. The third halving cycle’s all-time high, just like the second halving cycle’s all-time high, was achieved almost exactly halfway through the second year of the halving cycle! And, just like the bottom of the second halving cycle, the bottom of the third halving cycle, at least to date, occurred almost exactly halfway through the third year of the halving cycle.

There is a trend for bitcoin to reach an all-time high within the first 78,750 blocks of a new halving cycle. In fact, it is almost precisely at that point, 78,750 blocks into a new halving cycle, that bitcoin has reached its all-time high for that particular cycle. Similarly, the halving cycle lows of the past two cycles are each roughly 131,250 blocks in to the new halving cycle.

Another interesting insight the chart provides is the line representing the bitcoin price never intersects anywhere in the chart. In other words, the price of bitcoin has never been less at that specific point in the halving cycle compared to the previous halving cycle. The spiral has only grown outward. Will that continue until the final block reward is paid out in 2140? I’m skeptical. However, it would not be a surprise to see this trend continue for several more halving cycles as Bitcoin continues to become intertwined with the world’s economy.

Bitcoin recently entered the fourth year of the current halving cycle. If history is any indicator, this has been a good time to buy bitcoin. Admittedly, Bitcoin has never existed during a recession which could be looming over the world economy. It is easy to get caught up in the day-to-day volatile swings of the price of bitcoin and the mainstream media’s sensationalized claims that Bitcoin has died (474 times and counting), but viewed through the lens of the halving cycles a pattern may be emerging. A sound strategy may be to allocate a small percentage of one’s portfolio to bitcoin and then forget about it for two halving cycles without following the predictable price fluctuation that occurs over the short-term.

Even if a plan fiduciary is not ready to make bitcoin available to plan participants or place on a pension fund’s balance sheet, it is time for all plan fiduciaries to have a deep understanding of Bitcoin’s fundamental properties. One question that plan fiduciaries should ponder is: If this market cycle is not the right time for plan participants and plans to invest in bitcoin, how many more successful market cycles are needed?

I would highly encourage those who are interested in learning more about the Bitcoin halving cycle phenomenon to watch this insightful, concise presentation by @therationalroot from the 2023 Bitcoin Conference. As always, if you have any questions, please don’t hesitate to contact us.